Hydrogen Fuel Cell Vehicles: US Market Readiness & 2026 Adoption

By 2026, hydrogen fuel cell vehicles in the US face critical infrastructure hurdles and cost barriers, yet significant governmental and private investments are poised to accelerate market readiness and adoption rates.

As we approach 2026, the discussion around sustainable transportation intensifies, with hydrogen fuel cell vehicles emerging as a compelling, albeit complex, contender. This technology promises zero tailpipe emissions and quick refueling, presenting a powerful alternative to traditional internal combustion engines and even battery electric vehicles. Understanding its current standing and projected trajectory in the United States market is crucial for anyone interested in the future of mobility.

The Current Landscape of Hydrogen Fuel Cell Vehicles in the US

The US market for hydrogen fuel cell vehicles (FCVs) is still in its nascent stages, characterized by limited vehicle availability and a developing infrastructure. Despite significant technological advancements, FCVs have not yet achieved the widespread adoption seen with battery electric vehicles (BEVs).

Early Adopters and Regional Concentrations

California remains the primary hub for FCV deployment in the US, largely due to state-level incentives and a relatively more developed hydrogen refueling network. This concentrated effort has allowed for real-world testing and refinement of the technology, albeit on a smaller scale.

- Limited models available from select manufacturers.

- California leads in FCV sales and infrastructure development.

- Early adopters are often environmentally conscious or tech enthusiasts.

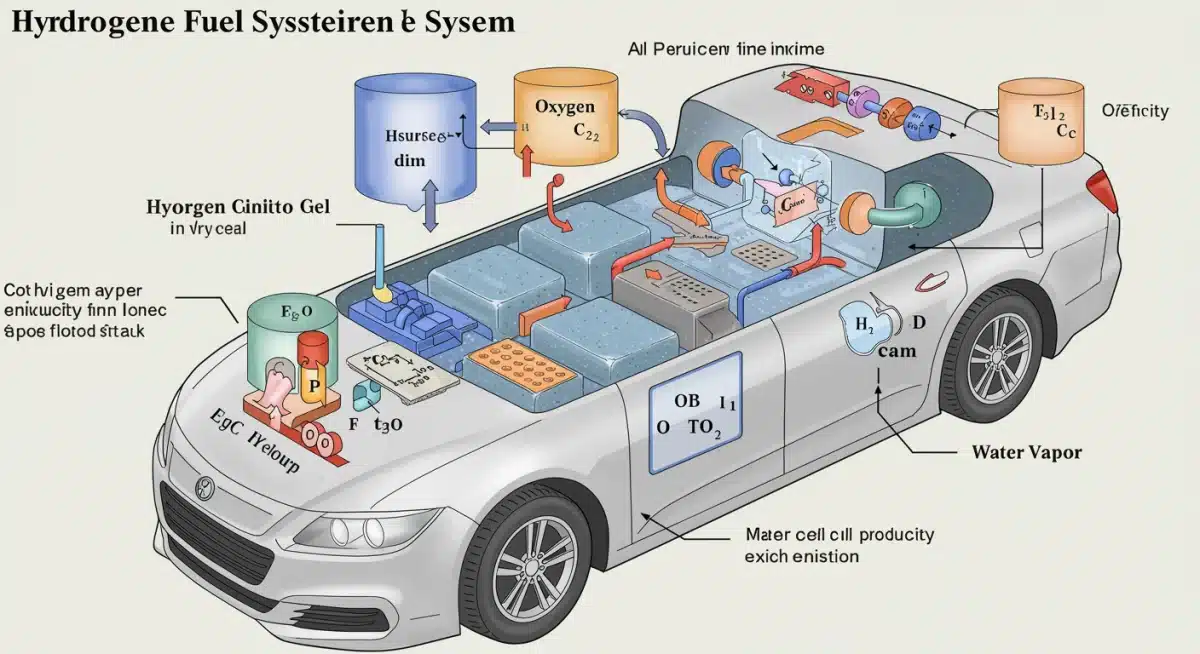

Technological Maturity and Performance

From a technological standpoint, FCVs are remarkably mature. They offer impressive range, often comparable to gasoline-powered cars, and can be refueled in minutes, a significant advantage over BEVs for certain use cases. The fuel cell stack, which converts hydrogen into electricity, has become more efficient and durable.

However, the cost of these advanced components, particularly the platinum used in fuel cells, continues to be a barrier to broader commercialization. Efforts are underway to reduce reliance on expensive materials and streamline manufacturing processes.

The current landscape indicates a technology ripe for expansion, but one that is heavily dependent on external factors like infrastructure and policy. Without these elements aligning, even the most advanced FCVs will struggle to gain traction beyond niche markets.

Infrastructure Challenges and Development by 2026

The Achilles’ heel of hydrogen fuel cell vehicle adoption in the US has consistently been the lack of a robust refueling infrastructure. While significant strides are being made, the pace of development is critical for meeting 2026 market expectations.

The Chicken-and-Egg Dilemma

Building a hydrogen refueling network requires substantial upfront investment, which is difficult to justify without a larger fleet of FCVs on the road. Conversely, consumers are hesitant to purchase FCVs without reliable and convenient access to hydrogen.

- High capital costs for building hydrogen stations.

- Permitting and regulatory hurdles can delay construction.

- Geographical distribution of stations is uneven, primarily in California.

Governmental Initiatives and Private Investments

Recognizing this challenge, both federal and state governments are allocating funds and implementing policies to accelerate infrastructure build-out. The Bipartisan Infrastructure Law, for instance, includes billions for hydrogen hubs and related infrastructure, aiming to create regional ecosystems for hydrogen production, distribution, and consumption.

Private companies are also investing in hydrogen production and distribution technologies, anticipating future demand. Partnerships between vehicle manufacturers, energy companies, and infrastructure providers are becoming more common, signaling a collaborative approach to overcoming these hurdles.

By 2026, we anticipate a noticeable expansion of the hydrogen refueling network, particularly in key corridors and established FCV markets. However, a truly nationwide network will likely remain a longer-term goal, requiring sustained investment and strategic planning beyond this timeframe.

Economic Viability and Cost Reductions

For hydrogen fuel cell vehicles to achieve widespread adoption, their economic viability must improve significantly. This involves reducing both the purchase price of the vehicles and the cost of hydrogen fuel.

Vehicle Manufacturing Costs

The current cost of FCVs is higher than comparable gasoline or battery electric vehicles, largely due to the specialized components like the fuel cell stack, hydrogen storage tanks, and power electronics. Manufacturers are actively pursuing economies of scale and technological innovations to drive these costs down.

- Developing cheaper catalysts to replace platinum.

- Streamlining manufacturing processes for fuel cell components.

- Increasing production volumes to lower per-unit costs.

Hydrogen Production and Distribution Expenses

The cost of hydrogen fuel itself varies significantly depending on the production method and distribution logistics. Currently, a large portion of hydrogen is produced from natural gas (grey hydrogen), which has environmental implications. The push is towards green hydrogen, produced via electrolysis using renewable energy, but this is presently more expensive.

Investment in large-scale green hydrogen production facilities and efficient distribution networks is crucial. By 2026, we expect to see modest reductions in the cost of green hydrogen, making FCVs more attractive to consumers from an operational expense perspective.

Government incentives, such as tax credits for FCV purchases and infrastructure development, play a vital role in bridging the economic gap. These incentives are designed to stimulate initial demand and support the industry until it can stand on its own economically.

Comparison with Battery Electric Vehicles (BEVs)

The future of sustainable transportation is often framed as a competition between hydrogen fuel cell vehicles and battery electric vehicles. While both offer zero tailpipe emissions, their strengths and weaknesses cater to different use cases and consumer preferences.

Refueling Time and Range

FCVs boast a significant advantage in refueling time, typically taking 3-5 minutes, comparable to gasoline cars. They also offer competitive ranges, often exceeding 300 miles on a single tank. This makes them appealing for long-distance travel and heavy-duty applications where quick turnaround is essential.

BEVs, while improving, still require longer charging times, especially for full charges, and their range can be affected by factors like temperature and driving style. However, the charging infrastructure for BEVs is far more widespread and accessible.

Infrastructure and Energy Storage

The electrical grid for BEVs is already largely established, requiring primarily charging station deployment. Hydrogen infrastructure, as discussed, is still in its nascent stages. From an energy storage perspective, hydrogen is a high-density energy carrier, making it suitable for larger vehicles and applications requiring sustained power.

- BEVs benefit from existing electrical grid infrastructure.

- FCVs excel in rapid refueling and longer range for specific applications.

- Hydrogen storage in vehicles presents engineering challenges.

By 2026, it’s unlikely that either technology will completely displace the other. Instead, they are more likely to complement each other, with BEVs dominating the light-duty passenger vehicle market and FCVs finding their niche in heavy-duty transport, fleet operations, and potentially longer-range consumer vehicles where refueling speed is paramount.

Policy and Regulatory Environment in 2026

The policy and regulatory environment in the United States will play a pivotal role in shaping the adoption rates of hydrogen fuel cell vehicles by 2026. Government support, incentives, and clear regulations are essential for fostering a conducive market.

Federal and State Incentives

The federal government has signaled strong support for hydrogen through various legislative actions and funding programs. This includes tax credits for FCV purchases, grants for infrastructure development, and initiatives to support green hydrogen production. State-level policies, particularly in California, have been instrumental in driving early adoption through rebates and dedicated infrastructure funding.

These incentives aim to reduce the total cost of ownership for consumers and lower the financial risk for companies investing in hydrogen technology. By 2026, the continuation and expansion of such programs will be critical for maintaining momentum.

Safety Regulations and Standards

Ensuring the safety of hydrogen storage, transport, and refueling is paramount. Regulatory bodies are continuously developing and refining standards for FCVs and hydrogen infrastructure. Public perception of hydrogen safety is also a factor, and robust safety protocols are key to building consumer trust.

- Tax credits and rebates reduce FCV purchase costs.

- Grants support hydrogen infrastructure build-out.

- Robust safety standards are crucial for public acceptance.

The regulatory landscape in 2026 is expected to be more streamlined and comprehensive, addressing issues from hydrogen production pathways to vehicle safety. This clarity will provide greater certainty for investors and manufacturers, accelerating the deployment of hydrogen technologies across the nation.

Projected Adoption Rates and Future Outlook for 2026

Forecasting the adoption rates of hydrogen fuel cell vehicles by 2026 requires considering current trends, infrastructure development, economic factors, and policy support.

Modest Growth in Passenger Vehicles

For passenger vehicles, adoption in the US is projected to see modest growth by 2026. While significant increases are not anticipated to rival BEVs, FCVs will likely solidify their presence in niche markets, particularly in regions with established refueling networks like California. New models from a wider range of manufacturers could also stimulate interest.

The convenience of quick refueling and long range will continue to attract specific consumer segments, especially those who frequently travel longer distances or require minimal downtime.

Significant Potential in Commercial and Heavy-Duty Sectors

The most substantial growth for hydrogen fuel cell technology by 2026 is expected in the commercial and heavy-duty sectors. Trucks, buses, forklifts, and port equipment are prime candidates for FCV adoption due to their demanding operational cycles, long routes, and the critical need for rapid refueling.

- Passenger FCV growth likely to be concentrated regionally.

- Commercial and heavy-duty sectors show stronger adoption potential.

- Government fleet conversions could boost numbers.

Government and corporate fleet conversions to FCVs could significantly boost adoption rates in these segments, driven by sustainability goals and operational efficiencies. The continued investment in hydrogen hubs will further support this transition, creating localized ecosystems for heavy-duty FCV deployment.

Overall, by 2026, hydrogen fuel cell vehicles are poised for a pivotal moment. While challenges remain, the convergence of technological maturity, increasing infrastructure, and supportive policies suggests a future where FCVs play an increasingly important role in the diverse tapestry of sustainable transportation ecosystem, offering a unique blend of efficiency, range, and environmental responsibility.

| Key Aspect | 2026 Outlook in US |

|---|---|

| Infrastructure Readiness | Developing, with regional hubs expanding beyond California, but still limited nationwide. |

| Adoption Rates (Passenger) | Modest growth, concentrated in specific regions with FCV support and refueling. |

| Commercial Sector Potential | Strong growth expected in heavy-duty transport and fleet operations due to efficiency. |

| Economic Factors | Vehicle and fuel costs remain higher than alternatives, but government incentives help bridge the gap. |

Frequently Asked Questions about Hydrogen Fuel Cell Vehicles

Hydrogen FCVs offer significantly faster refueling times, often comparable to gasoline cars, taking only a few minutes. They also typically provide longer driving ranges on a single tank, making them suitable for extended journeys and heavy-duty applications where minimizing downtime is crucial.

Currently, California leads the nation in hydrogen refueling infrastructure development. The state has invested heavily in building a network of stations to support early FCV adoption, making it the primary region where consumers can reliably operate these vehicles.

While significant cost reductions are being pursued, FCVs are likely to remain more expensive than comparable gasoline or BEV models by 2026. However, ongoing technological advancements and increasing production volumes will contribute to a gradual decrease in both vehicle and fuel costs, along with continued government incentives.

Government policies are critical, offering incentives like tax credits for purchases and grants for infrastructure development. These measures help offset the higher initial costs for consumers and reduce financial risks for companies investing in hydrogen production and distribution, thereby accelerating market growth.

The commercial and heavy-duty transportation sectors, including trucks, buses, and fleet vehicles, are projected to experience the most significant FCV adoption by 2026. Their operational demands for long range and quick refueling align perfectly with the advantages offered by hydrogen technology.

Conclusion

The journey of hydrogen fuel cell vehicles towards widespread adoption in the US is complex but promising. By 2026, while passenger FCVs will likely see modest, regionally focused growth, the commercial and heavy-duty sectors are poised for more substantial integration. Continued governmental support, private sector investment in infrastructure, and ongoing technological advancements aimed at reducing costs will be crucial determinants of their success. As the nation moves towards a cleaner energy future, FCVs are emerging as a vital component in the broader sustainable transportation ecosystem, offering a unique blend of efficiency, range, and environmental responsibility.